Experience the precision of EFI Markets API Trading Architecture, tailored for institutional brokers demanding market-leading innovation and integration capabilities:

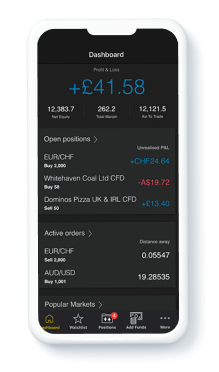

EFI Markets transforms capital management by merging FX and account balances into a unified account framework. This integrated approach facilitates more effective capital use, boosting the financial nimbleness of our clients.

EFI Markets distinguishes its offering with the capability to handle trading volumes starting at micro lots for a full spectrum of currency pairs, ensuring detailed risk management without ancillary fees. Our platform is engineered to support a wide array of trading strategies and sizes with unparalleled efficiency.

Tap into the specialized knowledge of EFI Markets ’ technology veterans, dedicated to advancing your connectivity framework. We prioritize the development of robust, low-latency connections that reinforce the reliability and speed of transactions between your services and your clientele.

At the heart of EFI Markets is an advanced execution model that goes beyond typical trade processing, offering a wide array of indices and commodity contracts. Tailored to meet the exacting requirements of automated traders, our platform provides high-level execution accuracy and extensive market depth.

EFI Markets paves the way for institutional clients to streamline their trading operations with our Prime Connectivity services. We provide an elite environment for direct market access across varied trading hubs, with the added advantage of unified account management. Our bespoke back-office solutions assimilate trading activity from multiple liquidity sources, affording clients a unified command over their trades and positions. Sophisticated checks before and after trades guarantee the strategic allocation of the net open position (NOP) and uphold trading efficiency.

EFI Markets champions a transparent prime brokerage model. Clients form direct relationships with execution venues, with commission structures that are straightforward and free from hidden costs. Our earnings are defined by transparent clearing fees, ensuring that our interests are aligned with providing you the best execution. EFI Markets operates with the integrity of an unbiased clearing partner, delivering a service model that respects client autonomy in venue selection.

Trade with confidence using EFI Markets ' comprehensive clearing solutions, which integrate leading platforms and banks into one efficient system. We provide access to a variety of execution venues, such as Currenex and EBS, amalgamating profit and loss statements in a single, easy-to-navigate back-office platform. This allows for a harmonized view of performance and risk across all trading activities.

With EFI Markets , manage your risk in real-time across multiple venues under one NOP limit, simplifying the complexity traditionally associated with multi-platform trading. EFI Markets eliminates the hassle of managing multiple intra-day limits, offering a singular, overarching NOP that streamlines your trading operations.

EFI Markets Prime services cater to a discerning clientele, starting with accounts designed for substantial trading volumes. We are the prime choice for:

EFI Markets redefines institutional trading with our API access, designed for the nuanced needs of professional and institutional traders. Our approach is client-centric, focusing on the customization of pricing strategies for each unique instrument and account. EFI Markets ’ liquidity experts excel in procuring optimal liquidity sources, ensuring that whether it's executing substantial single transactions or seeking consistent pricing for commodities, your tailored requirements are met with unparalleled precision.

Our long-standing partnerships with top-tier liquidity providers are your advantage. EFI Markets leverages these relationships to bring you pricing that aligns perfectly with your trading strategy.

Engage with EFI Markets ’ dedicated Liquidity Management Team, whose expertise lies in harnessing your trade data to negotiate and secure the most advantageous pricing and execution ratios, all in line with your specific trading needs.

Harness the collective benefits of EFI Markets Core and EFI Markets Pro ECN, ensuring a tailored fit for your specific market segments or individual trading instruments.

With EFI Markets , experience the ease of managing capital with the option to cross-collateralize returns and losses. Our system is designed for the savvy trader who values capital optimization and financial fluidity across accounts.

EFI Markets transforms your trading dynamics with our cutting-edge network architecture, designed to minimize overhead and swiftly position you in the marketplace:

EFI Markets empowers your trading operations with superior networking capabilities. By aligning with us, you gain access to an optimized network infrastructure tailored to bolster connectivity. Our hosting solutions, focused on providing your clients with reliable and high-speed connections, feature advanced redundancy protocols and are optimized for the lowest possible latency in data transmission.

Capitalize on EFI Markets ’ robust global infrastructure and the seasoned insight of our Technology Team. Host your platforms in an ecosystem developed to parallel the efficiency of our trading environments. Take advantage of the direct co-location with EFI Markets ’ transaction servers situated in key financial centers, guaranteeing minimal delay and maximum throughput for your trading activities.

EFI Markets offers flexible integration through our versatile API channels, encompassing FIX, .NET, and Java interfaces. Our APIs deliver extensive functionality, including comprehensive order types, in-depth market data, and sophisticated reporting tools, crafted to meet the needs of dynamic trading environments.

Access a broader landscape of trading solutions through EFI Markets ' strategic partnerships and third-party collaborations. Our infrastructure is seamlessly interconnected with leading bridge technologies and liquidity providers, ensuring that our clients benefit from a rich selection of trading platforms and analytical tools.