Report

On January 16, shares of Nvidia (NVDA.O) and Advanced Micro Devices (AMD.O) saw significant increases, driven by investor optimism surrounding the anticipated rise in demand for artificial intelligence (AI)-powered chips. This positive sentiment prompted Wall Street analysts to revise their price targets for these semiconductor giants.

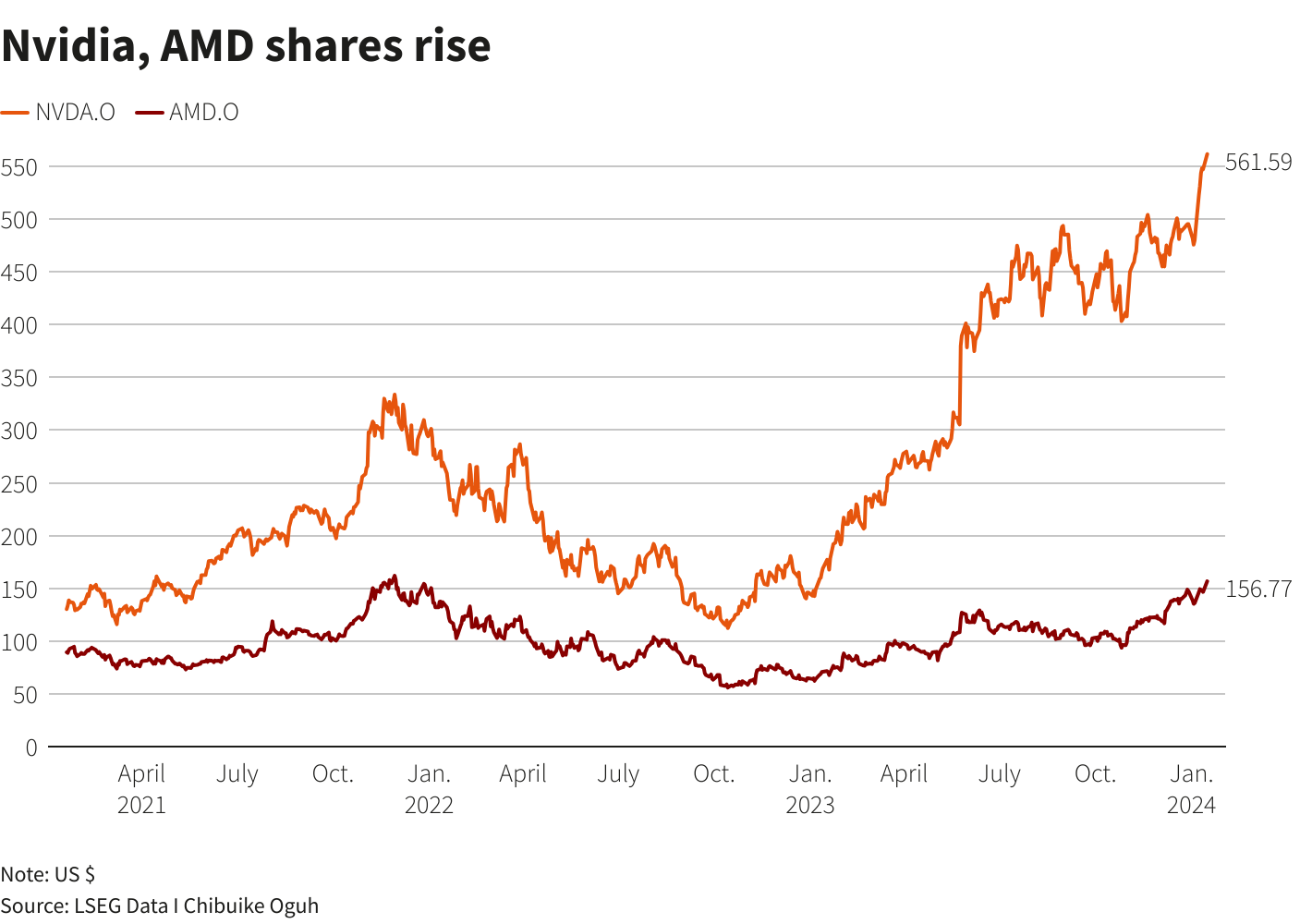

Nvidia, currently holding a dominant position in the advanced AI chip market, experienced a 3% increase in its stock, reaching a new record high of $563.65. Concurrently, AMD’s shares surged by 7.5%, hitting $157.57, marking their highest level in over two years.

Nvidia’s stock value more than tripled in the previous year, solidifying its status as the world’s most valuable chipmaker, while AMD’s shares more than doubled.

Analysts from Barclays, led by Tom O’Malley, highlighted AMD’s potential to gain ground in the AI chip market this year as the company ramps up deliveries to enterprise customers.

The analysts noted that supply constraints led customers to utilize the entire NVDA platform for priority shipments of accelerators. They also projected that 2024 would witness a significant opening up of the AI market, with other chipmakers like AMD expanding their market share.

Nvidia And AMD Shares

Barclays raised its price target for AMD shares from $120 to $200, and KeyBanc analysts increased theirs from $170 to $195. Nvidia also received a price target hike from KeyBanc, moving from $650 to $740. Both Nvidia and AMD currently stand out as top gainers in the industry-wide PHLX semiconductor index, which is up 1.15% in the session.

The median price target for Nvidia’s stock among 53 analysts is $625, slightly down from $627.50 a month ago, with a collective recommendation of “buy.” Meanwhile, the 47 analysts covering AMD’s shares project a median price target of $145, up from $130 a month ago, and also advocate buying the stock, according to LSEG Data.

In response to tightened U.S. export rules, Nvidia plans to commence mass production later this year of an AI chip tailored for its Chinese customers. Additionally, in December, AMD unveiled two new AI data center chips, signaling its intent to challenge Nvidia’s flagship microprocessors.