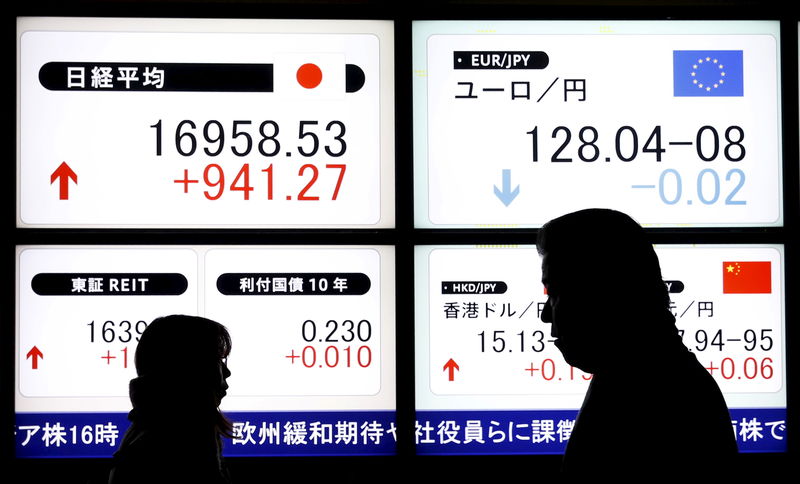

Most Asian stocks surge on Thursday, tracking overnight record highs on Wall Street. Softer consumer inflation readings in the U.S. have increased bets on interest rate cuts in 2024, providing a boost to the markets.

Wall Street Leads the Way

The strong performance of Wall Street helped Asian markets overlook headwinds from China and Japan. This was despite Japan’s economic contraction and the Biden administration’s increase in trade tariffs against Beijing. On Wednesday, Wall Street indexes finished at record highs, driven by softer-than-expected consumer price index data, which led traders to anticipate a rate cut in September. U.S. stock index futures also extended gains into Asian trade.

Asian Stocks Surge

Japan’s Nikkei 225 index rose by 0.6%, buoyed by technology stocks following gains in their U.S. counterparts. However, other economically-sensitive sectors and the broader TOPIX index, which has less tech weightage than the Nikkei, saw declines.

Economic Contraction in Japan

Japan’s economy contracted more than expected in the first quarter of 2024. Sticky inflation and lagging wages caused a sharp decline in private consumption. Additionally, capital expenditures, which had supported growth in previous quarters, slowed drastically as businesses became wary of investing amid economic uncertainty. The weak data cast doubts on the Bank of Japan’s ability to tighten policy this year. While loose policy may benefit stock market, a weakening economy presents significant headwinds.

Chinese Shares Lag Amid Trade and Economic Caution

China’s Shanghai Shenzhen CSI 300 and Shanghai Composite indexes lagged behind their regional peers, each rising about 0.3%. Hong Kong’s Hang Seng index also rose by 0.6%, relatively less than its Asian counterparts.

Impact of U.S. Trade Tariffs

Sentiment towards China was dampened by the Biden administration’s imposition of higher trade tariffs on several key Chinese sectors, including electric vehicles, medicine, and solar energy. Although the immediate economic impact of these tariffs remains unclear, they provoked a strong reaction from Beijing, which threatened retaliatory measures, potentially reigniting a trade war between the world’s largest economies. Anticipation of more economic data, such as industrial production and retail sales figures due on Friday, also contributed to caution.

Other Asian Markets Advance

Other Asian markets saw positive movements. Australia’s ASX 200 was the best performer, rallying 1.8% and nearing record highs. Data released on Thursday showed an unexpected increase in Australia’s unemployment rate, raising hopes that the labor market was cooling.

South Korea and India’s Positive Trends

South Korea’s KOSPI jumped 0.8%, driven by gains in technology stocks. Futures for India’s Nifty 50 index pointed to a positive open, with tech stocks set to follow global trends. However, gains are expected to be tempered by caution surrounding the upcoming 2024 Indian general elections.

Conclusion

The performance of Asian stocks was buoyed by optimism over potential U.S. interest rate cuts and strong overnight cues from Wall Street. Despite challenges from Japan’s economic contraction and ongoing trade tensions between the U.S. and China, the overall sentiment remained positive. Platforms tracking the stock market are likely to reflect these trends as traders adjust their strategies based on these developments.