The BoE may have an even more difficult time if UK inflation figures come in strongly. GBP/USD stays muted ahead of UK inflation data; GBP/AUD continues its downward movement following China and Australia data that strengthen the Australian currency.

The BoE may have an even more difficult time if UK inflation figures come in strongly. GBP/USD stays muted ahead of UK inflation data; GBP/AUD continues its downward movement following China and Australia data that strengthen the Australian currency.

BOE expectations and UK inflation GBP/AUD

The Bank of England (BoE) faces a greater difficulty than its competitor Central Banks because the UK continues to have the highest inflation rate when compared to the Euro Area and the US. Market investors are on edge as a result of this, as well as growing unemployment and a projected slowdown in GDP growth, since it appears probable that more rate rises may be required to see inflation decrease further.

The recent increase in inflation in the US and Canada as well as the increase in oil prices have given this viewpoint even more support.

Uptick in the UK and the BoE MPC meeting

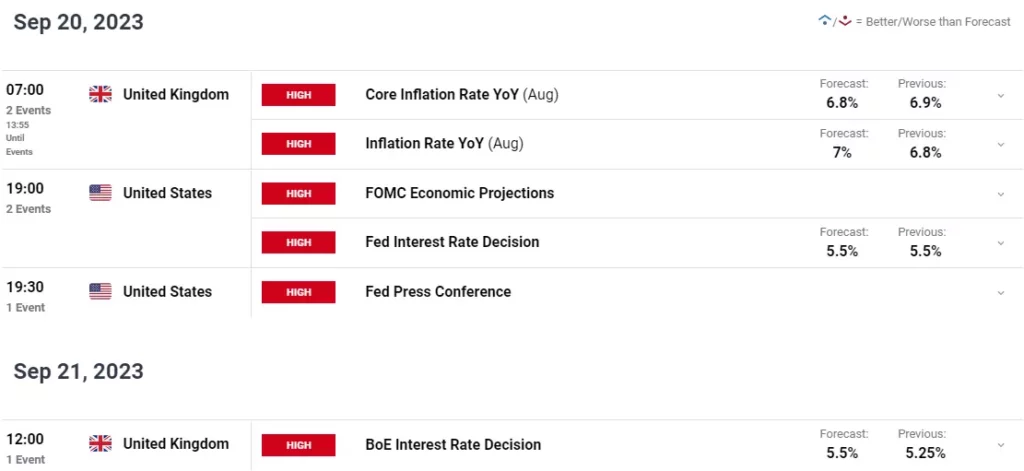

The next inflation print, which arrives one day before the BoE MPC meeting, is all the more significant in light of the recent increase in UK average wages. An increase in headline inflation would intensify pressure on the Bank of England (BoE), especially in light of the ECB’s unexpected rate move last week. I had advocated strongly for the BoE to implement at least one further 25bps boost; if inflation picks up tomorrow, I may reconsider and suggest an additional 25bps hike before 2023 expires.

The recent increase in inflation in both the US and Canada is a result of the main global economies. At the beginning of the hiking cycle, Canada was the first and most active of the major Central Banks.

Better Australian Data

Australian statistics have improved in response to the recent dip in the GBP. This has happened as Chinese authorities have stepped up their economic stimulus programmers. Despite the persistent problems in the real estate sector, the Chinese retail sales print did portray a slightly brighter image.

China’s Sentiment Cools

Markets were in danger of becoming chaotic due to the China situation, but since then, mood has improved. Initially, international fund managers sought to reduce their exposure to Chinese markets, but recent statistics indicate that this trend has been halted. This has resulted in recent gains for the Australian Dollar, which has contributed to the strong rebound of the GBP/AUD pair so far in September.

Technical Overview

This morning, GBPUSD tried to go towards the 200-day MA. The GBP/USD gave up early session gains to trade essentially flat at the time of writing due to the DXY’s recovery in the US session.

Cable is currently down 700 or so pips from the top in July due to the recent decline in UK statistics, notably GDP. In my honest view, UK inflation is expected to pick up speed tomorrow, which might act as a trigger and propel cable back towards the 1.2500 handle. Before the psychological 1.2500 level comes into sight, the 200-day MA around the 1.2434 level will act as the initial point of resistance.

Bottom Line

UK inflation and tomorrow’s Fed rate decision will make for an intriguing next two days for Cable. On Thursday, the BoE MPC decision will give us insights into GBPUSD’s Q4 direction, clarifying its potential path.