Nvidia (NASDAQ:NVDA) has been making waves in the market, and it’s not just the company’s stock that’s reaping the benefits. Three Exchange-Traded Funds (ETFs) with substantial positions in Nvidia – the VanEck Semiconductor ETF (NASDAQ:SMH), the iShares U.S. Technology ETF (NYSEARCA:IYW), and the Invesco S&P Momentum ETF (NYSEARCA:SPMO) – are positioned to capitalize on Nvidia’s remarkable performance and stand ready to capture further gains if the stock continues its upward trajectory.

1. VanEck Semiconductor ETF (NYSEARCA:SMH)

Focus and Positioning: With a focus on providing exposure to the top 25 most liquid U.S.-listed semiconductor companies, SMH boasts a sizable $16 billion in assets under management. Nvidia constitutes a significant portion of SMH’s holdings, making up over one-quarter of the fund’s assets with a weighting of 25.7%.

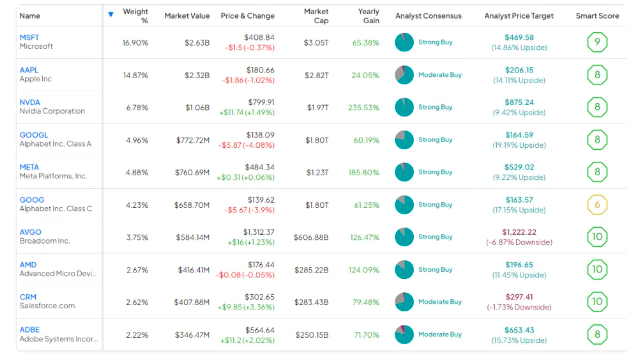

Portfolio Composition: The ETF also holds positions in Nvidia’s competitors like Advanced Micro Devices (NASDAQ:AMD) and Intel (NASDAQ:INTC), as well as key players in semiconductor manufacturing such as Taiwan Semiconductor (NYSE:TSM) and Applied Materials (NASDAQ:AMAT).

Performance and Outlook: SMH’s impressive performance track record, coupled with its 25.7% Nvidia position and highly-rated portfolio, makes it an attractive option for investors seeking exposure to the semiconductor industry.

2. iShares U.S. Technology ETF (IYW)

Objective and Holdings: In contrast, IYW aims to track the investment results of a U.S. equities index in the technology sector, encompassing electronics, computer hardware and software, and IT companies. While Nvidia constitutes a smaller 6.8% of IYW’s assets under management compared to SMH, the ETF offers a broader focus, including top holdings in various technology sectors beyond semiconductors.

Portfolio Diversity: With a strong performance history and a portfolio of highly-rated tech stocks, IYW presents a compelling investment opportunity, albeit with less direct exposure to Nvidia.

3. Invesco S&P 500 Momentum ETF (SPMO)

Strategy and Allocation: SPMO takes a different approach, basing its strategy on the S&P 500 Momentum Index, which tracks stocks with high momentum scores in the S&P 500 Index. While Nvidia comprises a smaller portion of SPMO’s holdings compared to SMH, it still holds a significant 11.4% position.

Diversified Holdings: SPMO’s diversified portfolio extends beyond the tech sector, including leading market performers like Meta Platforms and Eli Lilly. With a solid track record of performance and a low expense ratio, SPMO offers investors a cost-effective option to gain exposure to Nvidia’s growth potential.

Conclusion:

Diverse Opportunities: These three ETFs provide investors with diverse opportunities to capitalize on Nvidia’s exceptional performance. While each ETF offers its own investment strategy and level of exposure to Nvidia, they all present compelling options for investors looking to tap into the booming semiconductor industry and capitalize on the growth potential of leading tech companies.

Analyst Consensus: Analysts remain bullish on all three ETFs, reflecting their strong buy consensus ratings and positive price targets, signaling further upside potential in the coming months.

Trade while moving. Anytime, Anywhere

EFI Markets is a most trusted trading platform that simplifies trading through its efficient platform and a range of tools and features.