China’s stock market has been a hotbed of activity lately, with small-cap stocks finding themselves in the eye of the storm. Despite efforts by authorities to tighten trading restrictions, the downward spiral continues, raising concerns among investors and market watchers alike.

The Tale of Two Indexes: CSI 1000 vs. CSI 300

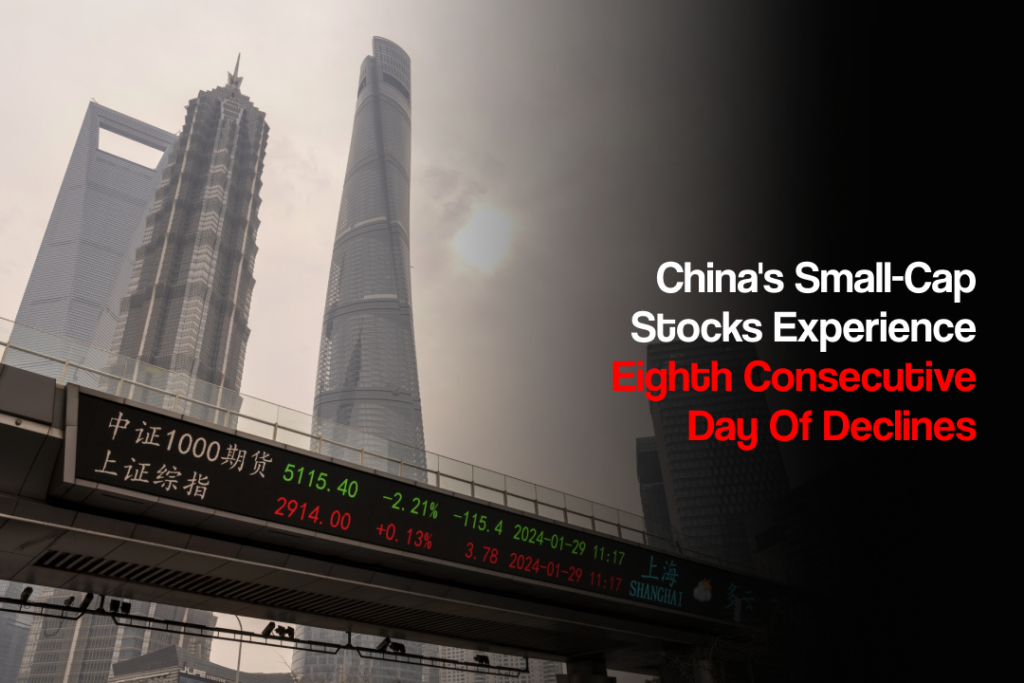

In recent trading sessions, the CSI 1000 Index, representing small-cap stocks, has taken a beating, plunging by as much as 2.3%. This decline compounds a staggering 19% loss over the last seven sessions. Conversely, the larger and more established CSI 300 Index has shown resilience, marking a modest 1% uptick.

Underperformance Raises Red Flags

The underperformance of small-cap stocks compared to their larger counterparts signals potential downside risks for the world’s second-largest equity market. Investors are on edge, especially amidst uncertainty surrounding Beijing’s ability to stabilize the situation.

Regulatory Ripples: Direct Market Access

Reports of stringent restrictions on quantitative hedge funds, including bans on sell orders and reductions in stock positions, have added fuel to the fire. These measures, part of a strategy known as Direct Market Access, are believed to have exacerbated the selloff in small-cap stocks.

Government Intervention: The National Team

To counteract the market turmoil, the “National Team” has reportedly injected billions into onshore Chinese shares. Despite these efforts, questions linger about the effectiveness of such interventions in reversing the downward trend in small-cap stocks.

Seeking Clarity Amidst Uncertainty

With ongoing regulatory changes and geopolitical tensions, uncertainty looms large over China’s equity market. Investors are cautiously navigating these turbulent waters, seeking clarity on the government’s strategy and the potential impact on market stability.

Looking Ahead: Vigilance and Action

As small-cap stocks continue to struggle, stakeholders must remain vigilant and take decisive action to restore investor confidence and market stability. The path ahead may be uncertain, but proactive measures are essential to weathering the storm.

In conclusion, China’s small-cap stocks are facing unprecedented challenges, testing the resilience of the country’s equity market. With uncertainties abound, only time will tell how policymakers and investors navigate these turbulent times.