Amazon (AMZN) Amazon’s recent fourth-quarter earnings announcement has sent waves through the financial world, painting a vivid picture of success and innovation. Let’s delve into the details of Amazon’s stellar performance and strategic maneuvers that have captivated investors and industry observers alike.

A Surge in Stock and Financial Prowess

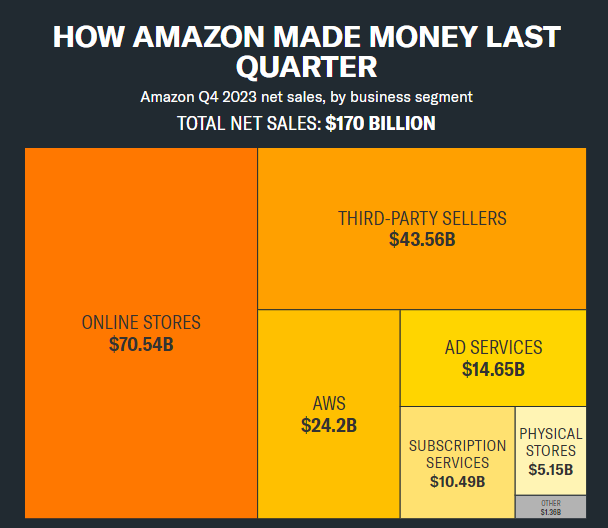

Amazon’s stock soared by nearly 7% in premarket trading following the unveiling of robust fourth-quarter earnings. The company’s net sales reached an impressive $169.9 billion, exceeding expectations by marking a remarkable 14% increase from the previous year. Notably, CEO Andy Jassy expressed satisfaction with the quarter, characterizing it as a record-breaking holiday shopping season, capping off a strong 2023 for Amazon.

Key Metrics and Outperformance

Breaking down the financial metrics, Amazon outshone Wall Street expectations across various fronts. Revenue, adjusted earnings per share, Amazon Web Services revenue, and advertising revenue all exceeded analyst estimates. This consistent outperformance underscores Amazon’s resilience and ability to deliver exceptional results, even amidst challenging market conditions.

Introducing Rufus: Revolutionizing Shopping with AI

Innovation remains at the core of Amazon’s success story. The introduction of Rufus, a new shopping assistant powered by generative AI, signifies Amazon’s commitment to enhancing the customer experience. Rufus’s ability to answer inquiries and recommend products on the Amazon mobile app heralds a new era of personalized shopping, initially available to select customers before a wider release in the US.

Strategic Shifts and Focus on AI Development

Moreover, beyond financial success, Amazon’s strategic maneuvers include job cuts in Prime Video, MGM Studios, and Twitch, signaling a shift towards more focused operations. Executives highlighted the growing interest in AI products among consumers, with plans for increased investment in AI operations in 2024. This focus on AI development aligns with Amazon’s vision to drive significant revenue growth, particularly in its cloud business.

Expanding Advertising Opportunities and Tech Innovations

Furthermore, Amazon’s expansion into advertising on Prime Video and the introduction of Amazon Bedrock underscore its commitment to innovation and revenue diversification. These initiatives, coupled with investments in AI startup Anthropic, highlight Amazon’s relentless pursuit of technological advancement and market dominance.

Dominance in Cloud Computing

Not to be overlooked is Amazon Web Services’ continued dominance in the cloud industry. Capturing approximately 30% of the market share, Amazon’s leadership in cloud computing remains unchallenged, reinforcing its position as a powerhouse in the tech realm.

In Conclusion: A Triumph of Innovation and Resilience

In conclusion, Amazon’s fourth-quarter success is a testament to its unwavering commitment to innovation, customer satisfaction, and strategic agility. As the company navigates through evolving market dynamics and embraces emerging technologies, its position as a global leader in e-commerce, cloud computing, and AI remains undisputed. As investors and industry observers await Amazon’s next move, one thing is certain: the journey of innovation and triumph continues.

Trade while moving. Anytime, Anywhere

EFI Markets is a most trusted trading platform that simplifies trading through its efficient platform and a range of tools and features.